|

|

|

|

LeRoy Coop

Departments

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Analysts Are Pounding the Table on This Red-Hot AI Stock/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)

Broadcom (AVGO) is a global technology leader specializing in the design, development, and supply of semiconductor and infrastructure software solutions for diverse sectors, including data centers, networking, broadband, wireless, storage, and industrial markets. Broadcom has expanded its portfolio through strategic acquisitions such as VMware, positioning itself at the forefront of cloud computing, AI, and cybersecurity advancements. Headquartered in California, it was founded in 1991 and has expanded its business presence across North America, Europe, Asia, Africa, and the Middle East. Broadcom Explodes in 2025AVGO stock has, except for the last couple of days, surged impressively in 2025; despite a slight drop of about 6% in the past five days, it has otherwise risen 14% over a month and an exceptional 78% in the last six months. The 52-week and year-to-date (YTD) gains are even more notable, at roughly 114% and 50%, respectively. This performance far outpaces the benchmark S&P 500 index ($SPX), which returned approximately 17% over the same 12-month period. Broadcom’s explosive rally reflects strong semiconductor and AI sector momentum, as well as positive sentiment from its recent strategic acquisitions and robust earnings growth.

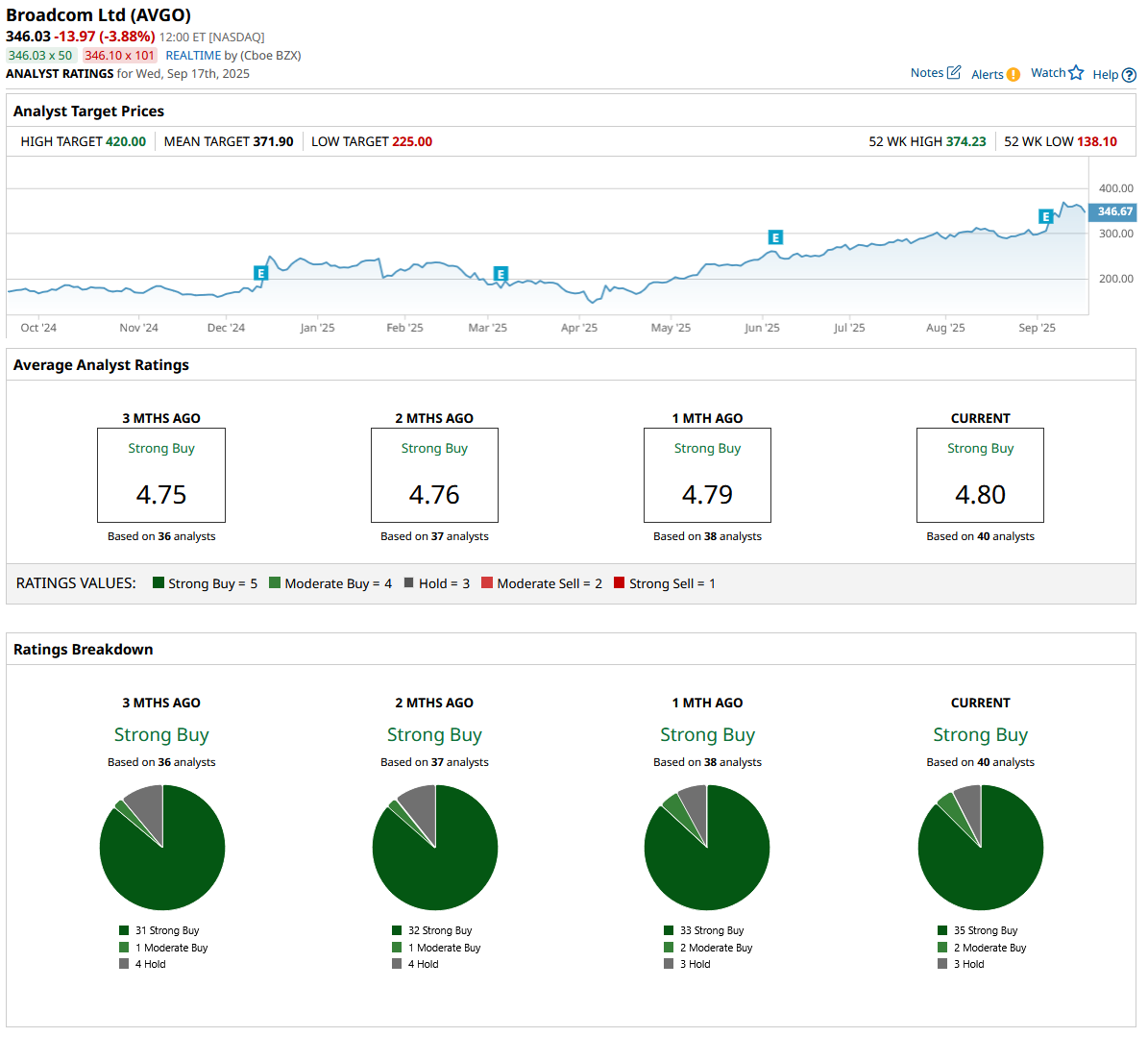

Broadcom Surpasses Analyst EstimatesBroadcom reported robust Q3 2025 results on Sept. 4, posting revenue of $15.95 billion, a 22% year-over-year (YoY) increase, while adjusted earnings per share reached $1.69, topping consensus estimates of $1.66. The strong top- and bottom-line beats highlighted accelerating demand for Broadcom’s AI chips and infrastructure software solutions, especially after its VMware integration. Delving deeper, Broadcom’s finances showed record GAAP net income of $4.14 billion and adjusted EBITDA of $10.7 billion, representing a solid 67% EBITDA margin. Free cash flow came in at $7.02 billion, or 44% of total revenue, while gross margin hit an impressive 78.4%. AI semiconductor revenue surged 63% YoY to $5.2 billion, accounting for a significant portion of the growth. The infrastructure software segment, which was driven by VMware, contributed $6.8 billion, up 17% YoY. Capital allocation strategies remained disciplined, with Broadcom paying $2.8 billion in dividends during the quarter. Looking ahead, Broadcom issued bullish Q4 guidance, projecting revenue of $17.4 billion, a 24% YoY increase, and expects the EBITDA margin to remain steady at 67%. The company’s outlook is underpinned by continued strength in AI and networking solutions, enterprise software expansion, and optimistic demand forecasts for data center accelerators. Broadcom Upgraded by AnalystMizuho Securities has substantially raised its price target for Broadcom, setting a new goal of $410 per share, up from $355, reflecting an upside of 14% from the current market price. The broker continues to rate Broadcom as “Outperform,” citing accelerating AI revenue forecasts: $39 billion for fiscal 2026, $60 billion for 2027, and a new $75 billion estimate for 2028, well above consensus numbers. Broader revenue forecasts were also upgraded to $84.4 billion for FY26 and $108 billion for FY27, with corresponding EPS estimates rising to $9.27 and $12.13. FY28 projections were introduced at $124 billion in revenue and $14.05 EPS. The analysts expect Broadcom’s AI revenues to grow at a hefty 56% compound annual rate, driven by rapid adoption of custom ASICs, expansion of client relationships, and new networking platforms. Notably, custom chips for hyperscalers like Alphabet (GOOG) (GOOGL) and Meta (META) are commanding higher average selling prices, while new ramps from OpenAI, Apple (AAPL), and ARM (ARM) are anticipated. Products like Tomahawk Ultra and SUE-lite are set to boost Broadcom’s presence in AI connectivity, improving efficiency for large model training. The firm expects annual free cash flow to reach $40 billion by FY26, supporting near-industry-leading margins of 77% gross and 66% operating. CEO Hock Tan’s pay is directly linked to major revenue milestones through 2030, and analysts see upside “potentially accelerating” in 2027 and beyond. Is AVGO a Buy?The AI stock is a favorite on Wall Street with a consensus “Strong Buy” from experts, with a mean price target of $371.90, reflecting an upside of 7.5% from the market rate. AVGO has been rated by 40 analysts so far, receiving 35 “Strong Buy” ratings, two “Moderate Buy” ratings, and three “Hold” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|