|

|

|

|

LeRoy Coop

Departments

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

How Gold, Grains, the U.S. Dollar, and Other Futures Markets Could React to the Fed Meeting Today

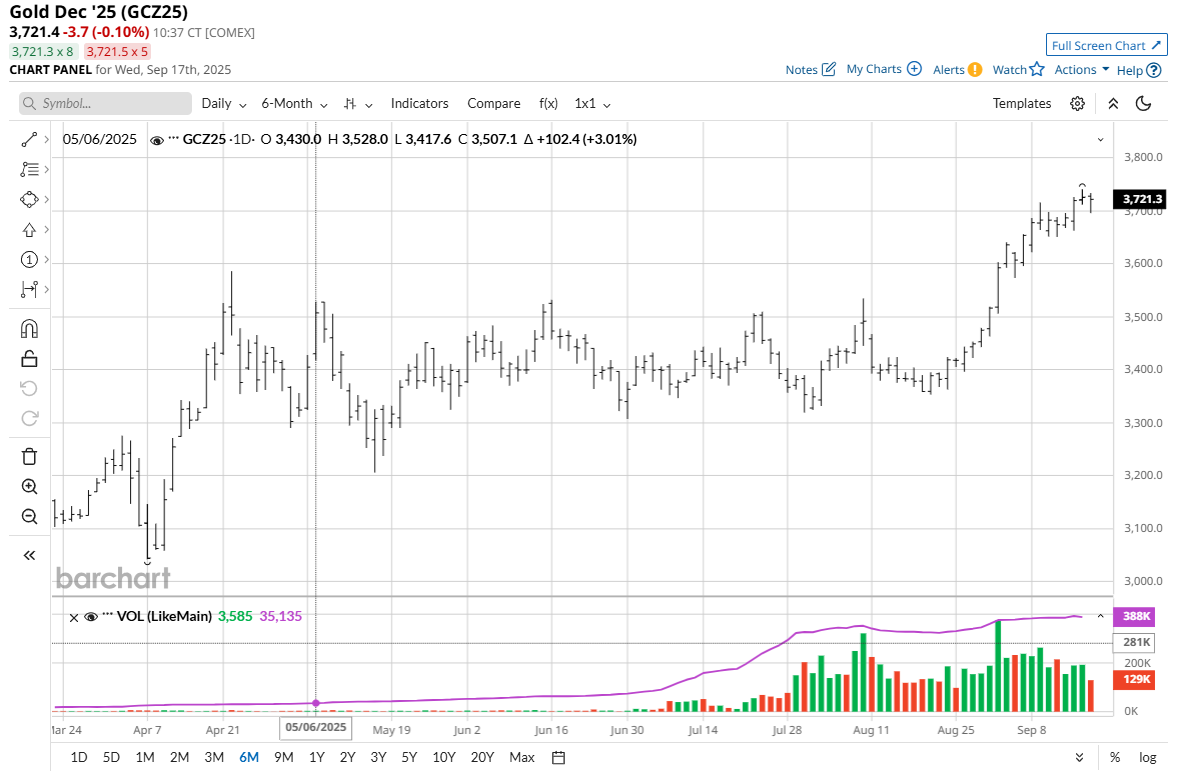

The Federal Reserve’s Open Market Committee (FOMC) meeting that began Tuesday morning ends this afternoon with a statement and press conference from Fed Chair Jerome Powell. The FOMC is widely expected to make a 25-basis-point cut to the Fed funds rate trading range, which would be the first since November 2024. This afternoon will also see updated Fed projections that may show slower U.S. economic growth and rising unemployment. Reporters will grill Powell at his press conference this afternoon, not only on the trajectory of the U.S. economy and interest rates, but also on the Fed’s independence. Some market watchers are calling this FOMC meeting the most important one of the year. I’m going to go out on a limb just a little bit here and speculate on what several markets will do following the FOMC meeting this afternoon and then in the coming days or few weeks. Gold and SilverThese two precious metals markets were seeing profit-taking and position-evening Wednesday morning, ahead of the FOMC conclusion. Gold (GCZ25) hit a record high on Tuesday, while silver (SIZ25) notched a 14-year high. It could well be that the gold and silver markets are experiencing a classic “buy the rumor, sell the fact” scenario regarding the likely Fed rate cut today. The metals’ prices rallied in anticipation of the rate cut and may continue to sell off right after the rate cut. I do not have a strong notion about how long the downside price corrections will last. However, the overall fundamental and technical postures for gold and silver remain firmly bullish. That means the present downside price corrections in gold and silver are likely a value-buying opportunity. The difficulty will be trying to time when the downside price corrections are over. They could last a couple days, a couple weeks, or even longer.

U.S. Dollar Index and the Euro CurrencyThe Euro currency (E6Z25) is trading near a four-year high and the U.S. dollar index ($DXY) (DXZ25) on Tuesday hit a nine-week low. Lower U.S. interest rates are greenback-bearish and Euro currency bullish — especially as some recent U.S. economic data, including the August jobs report, has been downbeat. Trends in the currency markets tend to be stronger and longer lasting than price trends in other markets. And with the marketplace expecting two more quarter-point rate cuts from the Federal Reserve this year, such suggests the USDX will keep trending down and the Euro currency will extend its current price uptrend for at least the next few weeks.

U.S. Treasury Bonds and NotesDecember U.S. Treasury bond (ZBZ25) futures prices today hit a nearly six-month high and are trending up. U.S. Treasury notes (ZNZ25) prices are near their recent six-month high and are also trending higher. Lower U.S. interest rates are bullish for U.S. Treasury prices (lower yields). I look for more price upside in Treasury bond and note futures markets in the coming weeks. U.S. Treasuries are also a safe-haven asset. This is the time of year when stock and financial markets can get extra wobbly, so it’s likely T-Bonds and T-Notes futures markets will continue to get better price bids than offers from traders.

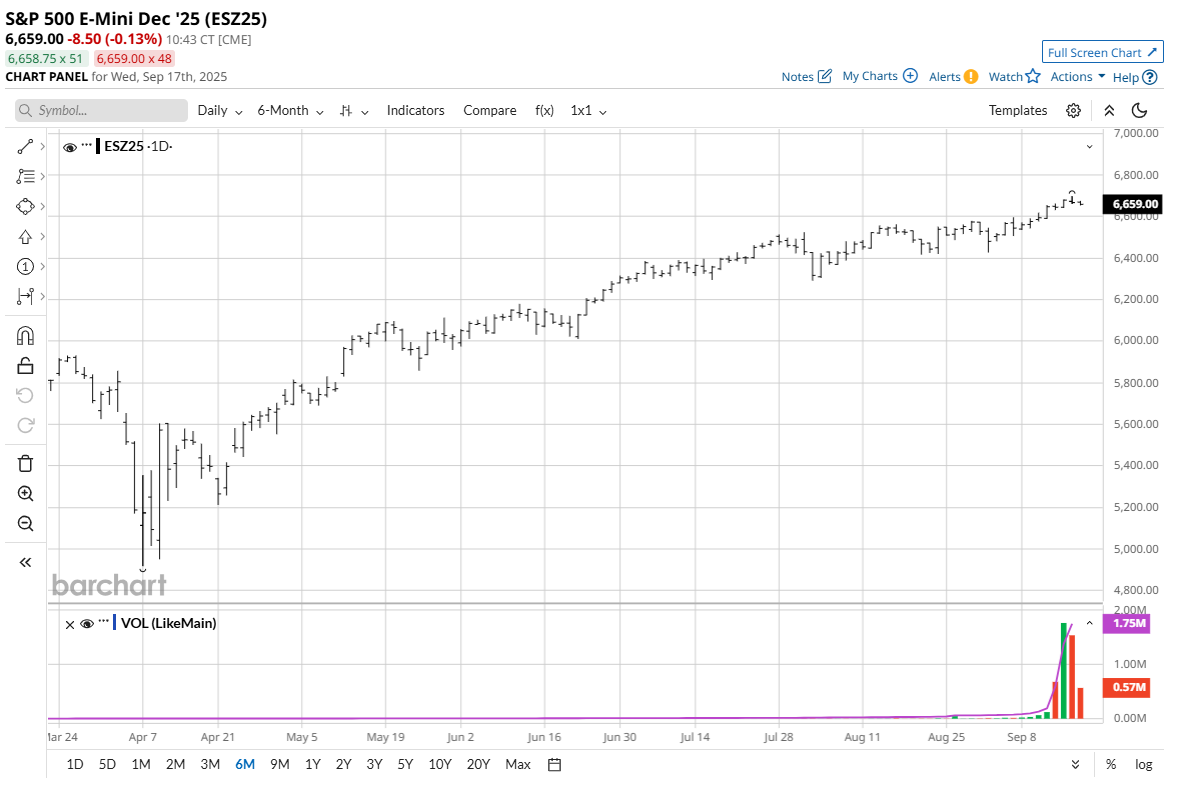

U.S. Stock IndexesThe S&P 500 ($SPX) and Nasdaq ($NASX) stock indexes hit record highs this week — right during what history has shown to be turbulent trading months of September and October. The stock market bulls are not out of the woods in this current period. However, low-volatility price uptrends are in place on the daily charts for the S&P and Nasdaq, which suggests those price uptrends can continue for at least the near term. Stock market bulls, “the trend is your friend” at present, which means the path of least resistance for prices will remain sideways to higher until a significantly bearish technical development occurs to suggest market tops are in place.

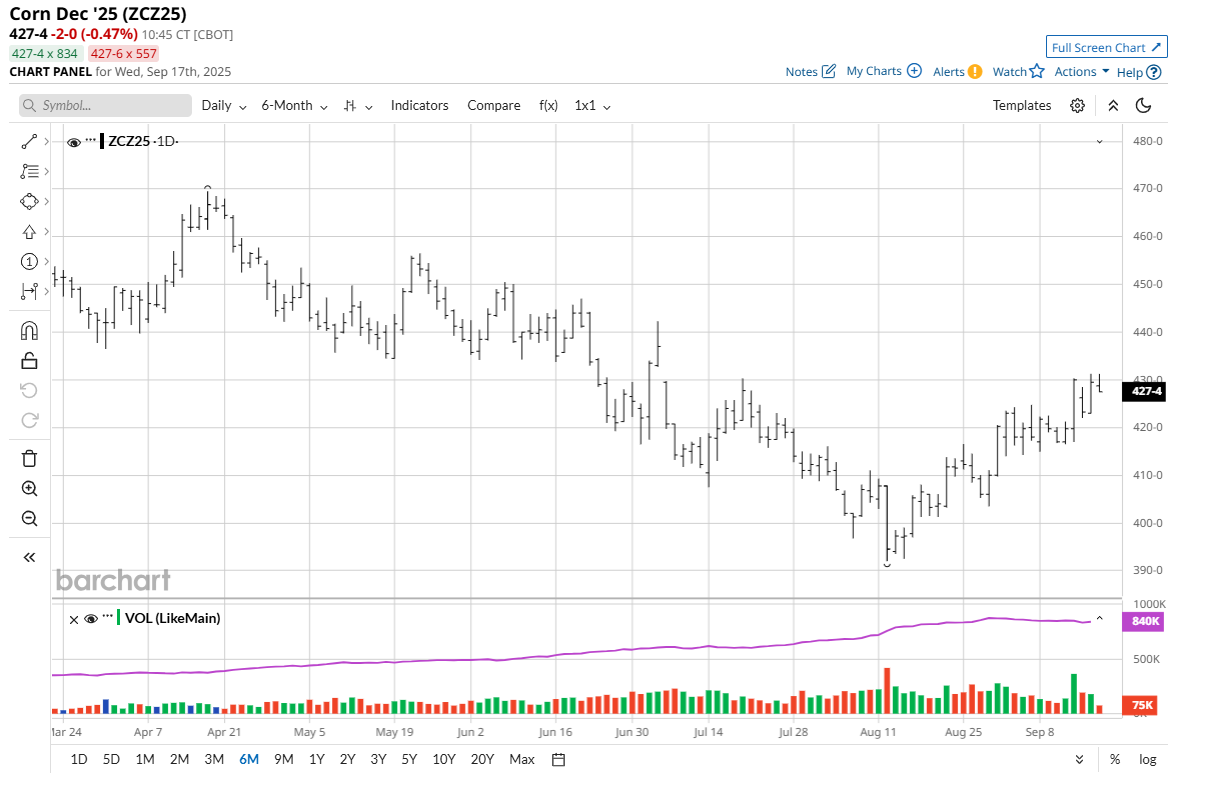

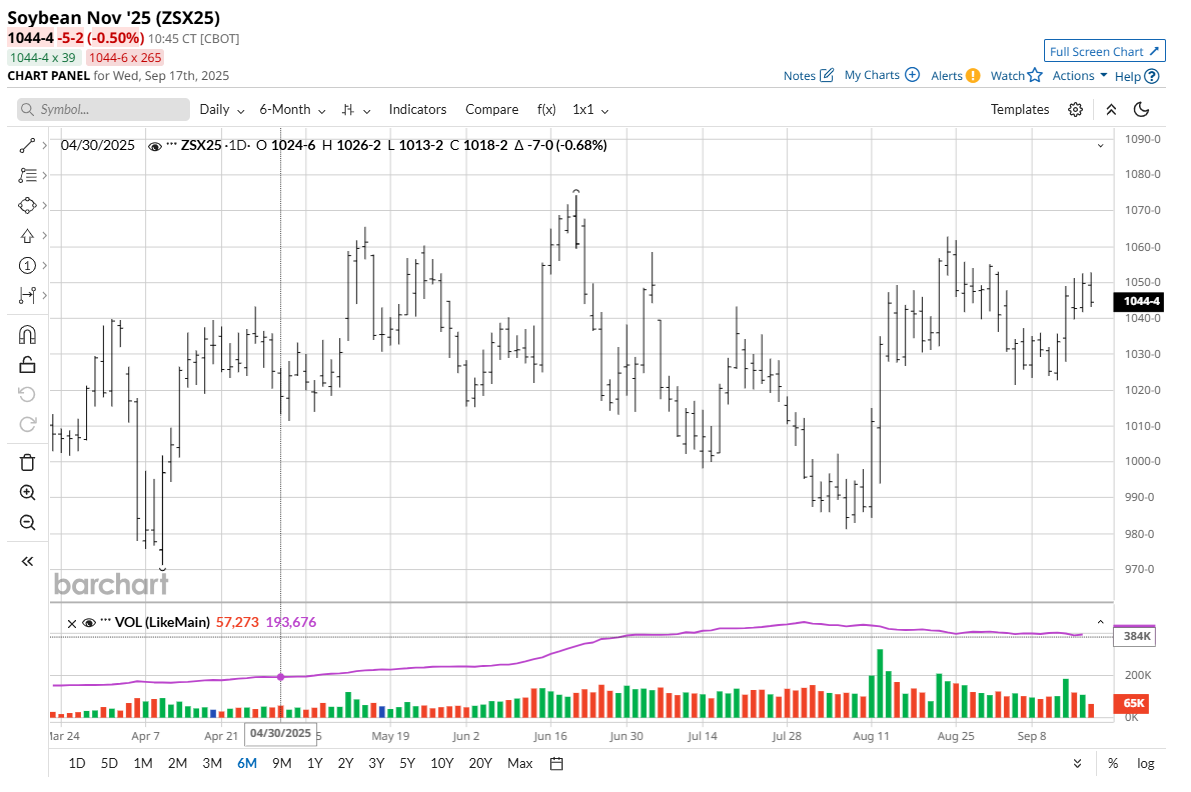

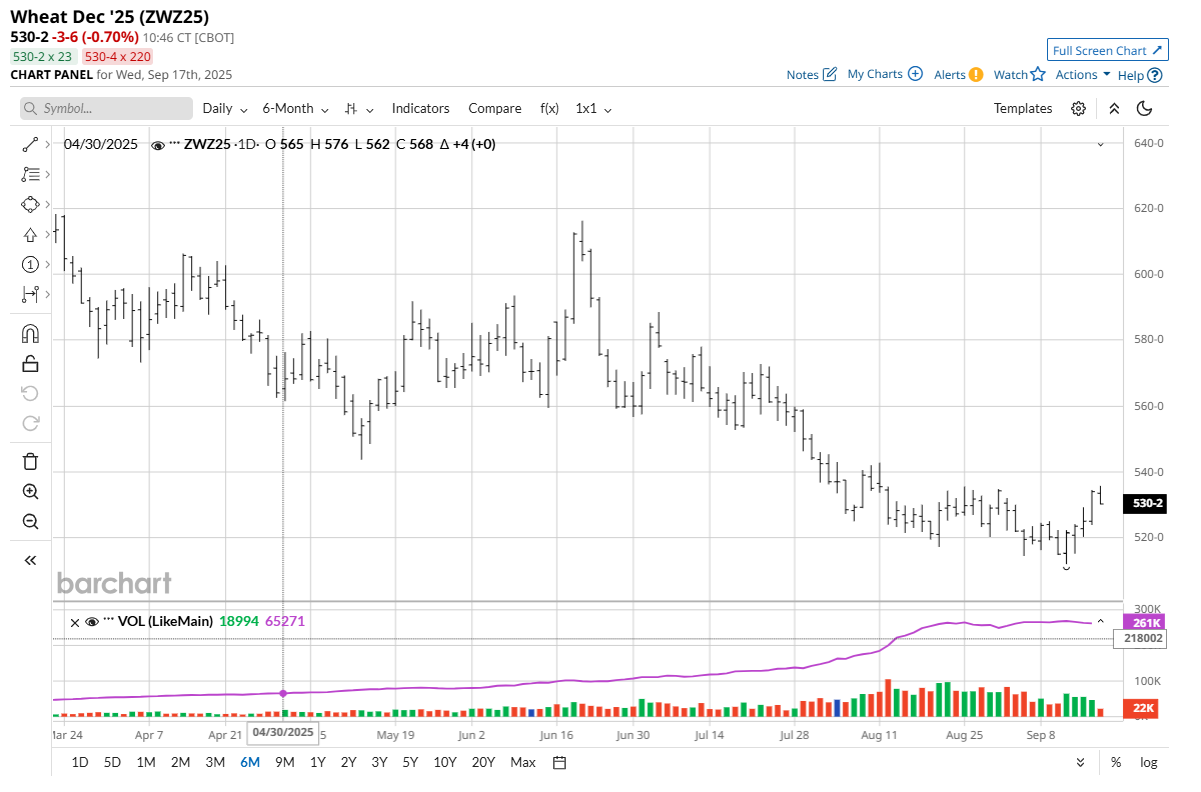

Grain MarketsThe grain markets have just recently perked up, led by corn (ZCZ25) and winter wheat futures markets this week hitting multi-week highs. Soybean (ZSX25) bulls have some momentum, too, but soybean meal (ZMZ25) futures have been a laggard. Meal futures prices need to start performing better for the soybean market to enjoy a sustainable price uptrend. Lower U.S. interest rates are a bullish fundamental for grain markets, on two fronts. One, lower interest rates (lower borrowing costs) prompt better consumer and commercial demand. Two, falling U.S. interest rates are U.S. dollar bearish. A depreciating U.S. dollar on the foreign exchange market means that U.S. grains on the world trade market are less expensive to purchase in non-U.S. currency. Most of world grain trading is priced in U.S. dollars. I look for the grain futures markets to trade sideways to higher into the end of year, and even after that.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com. On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|